February 1, 2024

Since Covid, we have been hearing from physicians asking about increasing their life insurance. From conversations we have found a significant percentage of young and mid-career physicians have high levels of debt and may be underinsured relative to their investments and family obligations. Senior physicians did not appreciate the tax issues pertaining to their estate, the tax burden on the shares of their corporations and the high tax erosion on the distribution of their hard-earned corporate investments to their heirs. We have been working with Sun Life to allow you to purchase additional life insurance with a 10% discount, competitive rates and a conversion option to permanent insurance.

Physicians can apply for up to $2,000,000 of term life insurance with a 10% discount.

- Physicians up to age 60 can apply for $2,000,000 with a 10% discount.

- Physicians ages 61-75 can apply for $1,000,000 with a 10% discount.

- Physicians up to age 85 can apply for permanent life insurance

- Ownership – Policies can be owned by your Medicine Professional Corporation.

- Discount – 10% on term life insurance.

- Policies are convertible to permanent life insurance.

- No minimum number to enroll.

- Limited time offer expires March 31, 2024.

This is an opportunity to allow physicians to revisit their life insurance needs with preferred underwriting, competitive pricing, a 10% discount on term insurance and a conversion option to permanent life insurance.

If you have questions, please call 416-222-1311 or email info@levinefinancialgroup.com. We recognize that insurance is not for everyone. If you do not wish to receive communications on this offer, simply email info@levinefinancialgroup.com.

QUESTIONS AND ANSWERS

What is term life insurance?

Term life insurance is temporary insurance. Premiums increase after the term ends and policies expire at age 85.

What is the discount on term insurance?

10%. The 10% discount is on standard term insurance, for the initial term. If a medical is completed and you qualify for preferred rates, you will get a 10% discount on the preferred rate.

Can I convert from term insurance to permanent life insurance?

YES. The conversion feature allows you to convert your term to permanent life insurance non medically up to age 75.

Can I exchange my term 10 policy to a longer term?

YES. You can exchange your term 10 or term 15 policy to a 20 or 30-year term policy. Term 20 exchanges must be done before the earlier of the seventh policy year or age 65. Term 30 exchanges must be done before the earlier of the seventh policy year or age 55. The 10% discount applies on the original term policy only.

Can my Medicine Professional Corporation own and pay for the life insurance?

YES. An advantage of corporate owned life insurance is that the corporate tax rate is usually lower than the shareholder’s marginal tax rate; there is typically a cost advantage to having the corporation own the policy and pay the insurance premium where the corporation owns a policy on the life of a business owner. The receipt of insurance proceeds by a corporation creates a capital dividend account (CDA*) credit which is calculated as the life insurance death benefit minus its adjusted cost base (ACB). Corporations can pay out tax-free dividends up to their CDA balance.

What is the application process?

Applications will be completed through Levine Financial Group. Depending on your age and the amount applied for, a non-medical or tele-interview will be completed.

Is this group life insurance?

NO. This is individual insurance where you or your corporation own and control the policy and can cancel it anytime.

Why is there a limited time enrollment period?

A limited time enrollment period protects the insurer against anti-selection.

Is there an age restriction?

– Applicants up to 75 can apply for term insurance.

– Applicants up to age 85 can apply for permanent life insurance.

What is permanent life insurance?

Permanent insurance is lifetime coverage. Policies are universal life or participating whole life.

– Universal life insurance offers permanent insurance with a level cost of insurance.

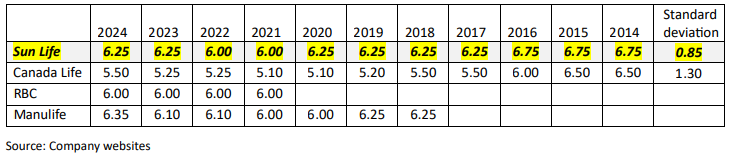

– A participating whole life insurance policy offers permanent insurance where your death benefit and cash value are guaranteed. The current dividend rate on participating whole life insurance is 6.25%.

Why do Physicians buy insurance and what type do they consider?

- Young and mid-career Physicians are concerned about protecting and providing for their family and often mix term and permanent insurance.

- Once Physicians are saving money in their corporation, some are looking for vehicles where they can invest funds tax efficiently. Often these physicians utilize a permanent whole life policy where funds grow tax free.

- Senior Physicians focused on estate planning issues often look at universal life insurance or whole life insurance to reduce their estate planning taxes, flow money through the corporation tax efficiently or charitable giving purposes.

How much life insurance should a Physician own if they are looking to replace their income?

The amount of insurance depends on how much income your family requires, the number of years they require income and the level of liquid assets you have. In general, each $1,000,000 of insurance/liquid assets only provides $47,000/year* after tax for 20 years. Afterwards, there will be no funds remaining. Life insurance fills the gap between your liquid assets and your family’s financial needs.

Why would physicians buy participating whole life insurance?

A participating whole life policy can be used to help fund retirement where funds grow tax free and as an estate planning tool. These policies give you the opportunity to earn policy owner dividends.

- Tax free growth. Similar to an RSP, funds inside a participating whole life policy grow tax free.

- Performance. Once dividends are paid, the increased cash value and death benefit value are guaranteed. The current dividend scale interest rate is 6.25% and is reviewed annually.

- Asset allocation. Sun Life is one of the largest debt providers in North America and its participating whole life portfolio is well recognized for its private fixed income and real estate portfolio.

- Guarantees. With participating whole life, the cash value and estate benefit value are guaranteed. Unlike stocks, bonds and mutual funds which fluctuate, once dividends are paid, these values are vested.

- Estate issues. Life insurance flows tax free to your corporation and tax efficiently to your heirs.

How are the assets in your Medicine Professional Corporation taxed when you and your spouse pass away and corporate assets are transitioned to your heirs?

Without any planning, corporate assets may be subject to up to three levels of tax.

- Personal capital gain on the deemed disposition of shares of the corporation

- Corporate tax on the sale of corporate investments.

- Dividend tax on distribution of assets out of the corporation.

How can I pass money through my corporation tax efficiently?

Life insurance flows tax free to your corporation and tax efficiently to your heirs.

The numbers:

Let’s assume you and your spouse are both 70 years old. If you purchase a joint last to die insurance policy for $1,000,000, your corporation will invest $28,235/year and get back a tax-free payment of $1,000,000 when you both pass away. Assuming life expectancy is age 85, if you had invested the same premium in your regular corporate investments, your corporation would have to earn a pretax annual internal rate of return of 10.3% which shows life insurance is an excellent estate asset. Furthermore, because this is a corporate owned asset, $750,000 of the death benefit flows through your corporations’ capital dividend account tax free to your heirs further enhancing the rate of return. The remaining $250,000 would be a taxable dividend.

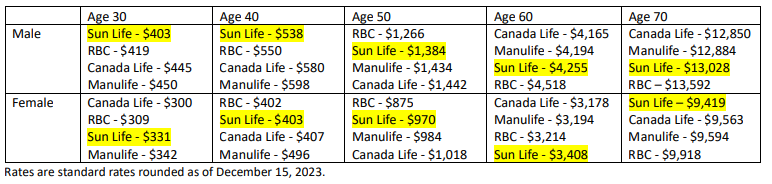

How do the 10-year term rates compare to other companies?

Our negotiated rates are highly competitive. Below is an annual rate comparison for $1,000,000 of term 10 life insurance with a conversion option to universal and whole life.

How do the whole life insurance dividend scale interest rates compare?

Sun Life has a highly competitive whole life insurance dividend scale interest rate with low volatility.

How do I enroll for this special offer?

Call Levine Financial Group at 416-222-1311 or email info@levinefinancialgroup.com