Since COVID started, our clients have been looking at their investments, insurance and wealth plans. With this in mind, we wanted to take a client scenario and help you understand how you can use whole life as a corporate savings plan for retirement and estate planning purposes.

What is participating whole life insurance?

A participating whole life insurance policy is an asset accumulation, estate, and retirement planning vehicle. It is designed to enhance the cash value in a long-term dividend interest rate earning asset class while providing guaranteed cash value and permanent life insurance. This policy is currently classified by the Canada Revenue Agency (CRA) as a tax-exempt life insurance policy for taxation purposes and we assume that the current Income Tax rules regarding life insurance will remain the same. Participating whole life insurance is not considered a passive investment by the Canada Revenue Agency (CRA) and is an attractive asset class for corporate funds to help fund retirement and for estate planning.

How can a participating whole life policy help fund retirement or be an estate planning tool?

- Tax free growth. Similar to an RSP, money inside a whole life policy is deemed by Revenue Canada to be tax-exempt and therefore grows tax free.

- Performance. The current dividend interest rate is 6.0%.

- Asset allocation. For example, with the Sun life Par plan, Sun life is the third largest debt provider in North American investing in Hospitals, Bridges and Roads making its asset allocation conservative with a history of robust performance in a participating insurance policy which means by law, the insurer must return 97.5% of the profit of the insurance portfolio to its policy holders (you).

- Diversification. Perhaps most important is the fact that the traditional investment portfolio of stocks and bonds is no longer working and whole life is an alternative asset class.

- Guarantees. With participating whole life, every year you get a policy statement the cash value and estate benefit value are guaranteed. Unlike your regular investments (stocks, bonds, mutual funds) which fluctuate year by year, every year dividends are paid in, these values guaranteed and vested.

What is guaranteed?

Each and every year as you get a policy statement these values are guaranteed. This means at the current dividend rate, unlike regular investments that fluctuate year by year, every year as your dividends are paid in, values are vested and guaranteed never to go down.

How does whole life reduce your corporate tax?

Your regular corporate investments are subject to a tax rate of 50.17%. Participating whole life insurance insurance grows tax free.

How can you access the cash value in your whole life policy?

There are four ways to access the cash value in your policy; a policy loan, a cash withdrawal, selling paid up additions or a loan from a financial institution. This is a common corporate retirement savings plan strategy. A corporate retirement strategy can be structured with either the corporation or shareholder borrowing against a corporate owned life insurance policy.

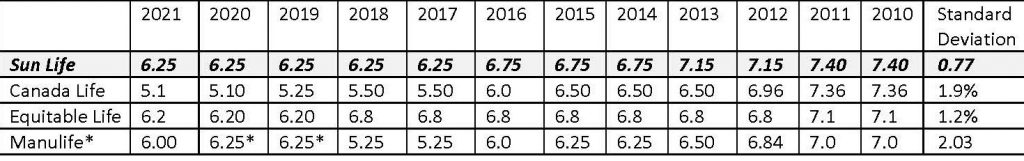

Are all companies whole life policies created equal?

NO. When looking at a whole life policy, sustainability is a key element. 2020 was a very unpredictable year and Canada Life and Manulife both predicted interest rates would increase. In fact, interest rates decreased and some carriers were forced to decrease their dividend twice in one year.

Sun Life has been and continues to be a stable plan with the highest dividend rate and the lowest risk (measured by standard deviation).

The numbers:

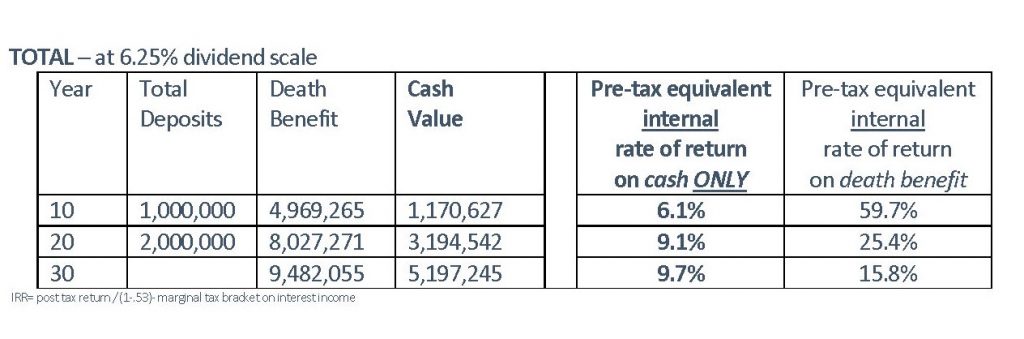

We looked at a 35 year old physician who is earning $750,000 per year and saving $300,000 per year in his corporation. We suggested reallocating $100,000 into a corporate owned whole life policy for 20 years. As part of our analysis, we illustrated the pre-tax equivalent rate of return he would have to earned in an alternative investment (fixed income) to have the same after-tax cash value and death benefit as projected in the participating whole life insurance portfolio.

When looking at a pre-tax equivalent rate of return at the current dividend rate of 9.1% at year 20 on the cash value only, it is nice to see how well this complements his other investments as a conservative asset class PLUS he will have access to tax free dollars for estate planning purposes.

One asset that your corporation can own that is guaranteed to grow each and every year is participating whole life insurance.

If you want to revisit your insurance click here, call Elliott or Efe at 416-222-1311 or email info@levinefinancialgroup.com

Elliott Levine, MBA, CFP is the President of Levine Financial Group in Toronto

We Save Physicians Money on their Insurance

416-222-1311 I info@levinefinancialgroup.com

Illustrated at the current Sun life dividend rate of 6.25%