Upon death, a taxpayer is deemed under paragraph 70(5)(a) of the Income Tax Act to have disposed of all capital property, subject to certain exceptions, for proceeds equal to their fair market value at the time of death. Any resulting capital gain must be reported in the taxpayer’s income tax return for the year of death (terminal return). Included in income at death is the net capital gain recognized under the deemed disposition rules.

The deemed disposition rules treat capital property owned by the deceased as if it were sold immediately prior to death. Thus, all unrecognized capital gains and losses are triggered at that point with the net capital gain (gains less losses) included in income. The Income Tax Act does contain provisions to defer the tax owing under the deemed disposition rules if the asset is left to a surviving spouse or to a special trust for a spouse (spousal trust) created by the deceased’s Will.

In general, here is how assets are taxed as of 2021

- Registered assets (RRSP/RRIF) – The value of the RRSP/RRIF is taxed as income. The highest marginal tax rate is 53.53%

- Non-Registered Investments – Gains are subject to capital gains tax of 26.76%

- Vacation property/cottage – Gains are subject to capital gains tax of 26.76%

- Tax free savings account – The value flows tax free.

- Primary residence – The family home flows tax free.

What about the shares of your medicine professional corporation?

Generally, when the shareholder of the corporation dies (you) and is survived by their spouse, the shares can be transferred to a spouse or spousal trust tax-free.

When you and your spouse pass away and the corporate assets are sold and distributed, there are up to 3 levels of tax occur.

- Personal capital gain on the disposition of shares of the corporation. The corporation was setup with a value of $1. The deemed value of the corporation’s shares at the time of death is the fair market value of the corporate investments which will be taxed as a capital gain as the shares are deemed to have been disposed.

- Corporate tax on the sale of corporate investments.

In order for the beneficiaries to receive their portion of the corporation’s investments, they must sell them. This sale results in a taxable capital gain. It also generates a refundable dividend tax on hand (RDTOH) and a capital dividend. - Dividend tax on distribution of assets out of the corporation.

When the investments are sold and cash is distributed to their heirs, the distribution is a dividend taxable at the heirs’ personal tax rate.

In order to understand how your corporate investments are taxed when you pass away, we start by looking at two physicians and how they manage their assets during their working years and the tax implications to their estate when they pass away and the assets are sold and distributed.

Dr. Smith and Dr. Brown are 50-year-old physicians and live next door to one another. Each earns $750,000 and has no mortgage. They both have $500,000 in RSPs and $1,200,000 in corporate investments where they invest $150,000 a year. Both plan to retire at 70 and earn a 5% return in a diversified portfolio (stocks, bonds, ETFs).

What sets them apart is

– how they invest their corporate funds –

Dr. Smith invests his $150,000 a year in a diversified investment portfolio. He doesn’t own life insurance. At age 70, he will have $2.4M in his RSP and $5.9M in his corporate portfolio.

Dr. Brown invests her $150,000 by putting $100,000 into the same diversified portfolio and $50,000 into a participating whole life insurance policy. At age 70, she will have $2.4M in her RSP, $3.2M in corporate investments, $3.1M of cash in her participating insurance policy and a death benefit of $5.8M[i].

Who is better off?

Ages 50-69 – During their working years…

Dr. Smith has more in liquid assets. He pays more tax as the income on corporate investments is taxed at 50.17% and his portfolio is subject to market volatility.

Dr. Brown pays less tax as the funds in her participating whole life insurance grow tax-free. Unlike traditional investments, the funds in her whole life portfolio are guaranteed to grow every year and she can access the cash value in her policy tax-free.

Age 70-84 – During retirement….

Both have an identical retirement income of $400K per year for life.

When they pass away…

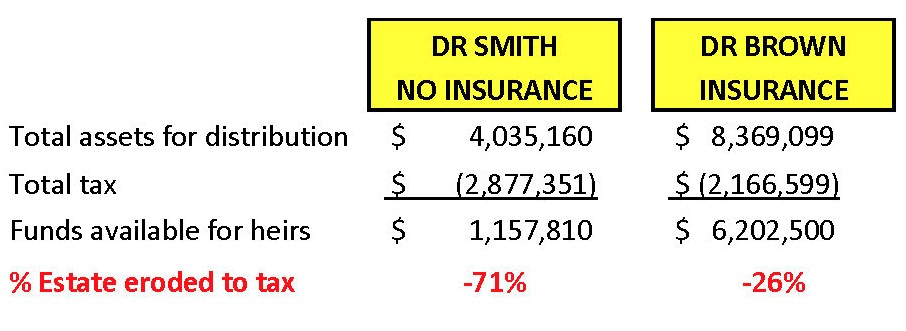

Both physicians have significant assets in their corporate investments and both want these assets distributed to their heirs after they and their spouse pass away in the most tax efficient manner.

The difference is

how their assets are treated from a tax perspective

Implications:

Dr. Brown focused on accumulating assets tax efficiently, minimizing tax and using the tax-preferred treatment of life insurance to enhance her estate which resulted in her far more efficient estate distribution after tax.

The amount of tax payable will ultimately depend on the type of post-mortem planning that is done and whether or not there are planning tools available at the time you and your spouse pass away. Loss carry back planning, pipeline planning, a transfer of shares and liquidation of assets or a combination of these strategies may be useful if they are available at the time you and your spouse pass away. One tool that is guaranteed, not subject to tax and flows through your corporation tax-free is permanent life insurance. The effect on your estate is significant.

If you want to revisit your insurance click here, call Elliott or Efe at 416-222-1311 or email info@levinefinancialgroup.com

Elliott Levine, MBA, CFP is the President of Levine Financial Group in Toronto

We Save Physicians Money on their Insurance

416-222-1311 I info@levinefinancialgroup.com

[i] Illustrated at the 2020 dividend scale for Sun Life of 6.25%.