Most physicians are incorporated and save money inside their professional corporations. You may choose to invest in stocks, bonds, mutual funds, or whole life insurance. The purpose of this article is to help demystify whole life insurance as a savings, retirement and estate planning tool.

What is Participating Whole Life Insurance?

A participating whole life insurance policy is permanent life insurance where the cash value and death benefit grow over time and can be utilized for retirement and estate planning purposes. This policy is classified by the Canada Revenue Agency (“CRA”) as a tax-exempt insurance policy, and we assume that the current tax rules regarding life insurance will remain.

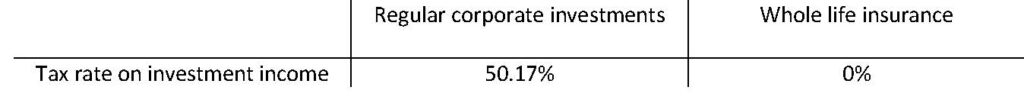

How is investment growth taxed in a whole life policy?

The funds inside a whole life policy grow on a tax free basis whereas traditional corporate investments (stocks, bonds, mutual funds) are subject to tax on the investment income of up to 50.17%.

How can a participating whole life policy help fund retirement or as an estate planning tool?

1. Tax free growth. Similar to an RSP, growth inside a participating whole life policy grow tax free.

2. Performance. The current dividend interest rate is 6.25% and is updated annually.

3. Asset allocation. Participating whole life portfolio is recognized for its asset allocation.

4. Guarantees. Every year you get a policy statement the cash value and estate benefit value are guaranteed. Unlike stocks, bonds and mutual funds which fluctuate year by year, once dividends are paid, these values are vested.

5. Estate issues. Life insurance flows tax efficiently through your corporations’ capital dividend account.

How do the funds in a whole life policy grow?

Funds inside a whole life policy grow on a tax deferred basis. They grow based on a dividend scale interest rate (“DSIR”) which is set annually for the next year by the insurance carrier in Spring. Dividends are credited on the policy anniversary based on the DSIR at that time. The current DSIR is 6.25%.

Most clients look at a whole life insurance policy like a tax-free savings account (“TFSA”) on steroids.

What is “smoothing” and how does it work?

The whole life portfolio uses a smoothing process on the dividend scale interest rate to amortize gains/losses over longer periods. By smoothing out market and interest rate changes, the impact of volatility and short-term fluctuations is markedly decreased, thereby providing a more stable return on all asset classes than if investment gains and losses had occurred annually.

Is the growth rate in a participating policy the same as the dividend scale interest rate?

No. The dividend scale interest rate is just one component used to determine policyholder dividends and the performance of an individual participating policy. Performance is affected by the design of the participating life insurance product, the pattern of guaranteed cash values, the number of premiums paid to the policy and by the age and risk characteristics of the insured person.

What is guaranteed in a participating whole life policy?

With participating whole life, every year you get a policy statement the cash value and estate benefit value are guaranteed. Unlike stocks, bonds and mutual funds which fluctuate year by year and are taxed in excess of 50%, once dividends are paid, these values are vested and grow tax free.

How has participating whole life held up during severe economic events?

There have been 15 financial stress tests since 1929. The most significant recent recessions include the COVID-19 recession, the Great Recession of 2008, and the Dot-Com Bubble of 2000. During these periods, asset prices declined significantly, and GDP also contracted, creating challenging environments for investors trying to grow or even just protect their net worth. Financial crises can rarely be anticipated or pre-empted because investor behavior is both irrational and unpredictable. Despite these severe economic events, participating whole life insurance has held up very well for 150+ years. This is because it is not based solely upon factors like stock market returns, short-term interest rates, or the latest fads / consumer hype. Unlike a traditional stock and bond portfolio which, at periods, might have neared collapse under various market strains, participating whole life has guarantees built-in and has paid a dividend during every economic stress test of the past 100 years (yes, this includes 1929-1932 Depression and the 2008 Great Recession). As an asset class, whole life insurance is a proven performer even in the toughest environments.

So now that I understand how whole life works, what can it do for me?

How can you access the cash value in your whole life insurance?

There are four ways to access the cash value in your policy; a policy loan, a cash withdrawal, selling paid up additions or a loan from a financial institution. A corporate retirement strategy can be structured with either the corporation or shareholder borrowing against a corporate owned life insurance policy.

- If the corporation is the borrower, then the corporation can pay the loan proceeds to you or other shareholders as a taxable dividend.

- If you personally are the borrower, then you will pay a guarantee fee back to the corporation to avoid triggering a taxable benefit. CRA suggests that the guaranteed fee should be “reasonable,” using the CRA’s Prescribed Rate, there be a record kept of the agreement and ongoing fees paid and the corporation and the individual and should review the agreement annually.

- Deductible interest. If you use a loan to buy income-producing investments, the interest on this loan may be deductible. We recommend funding the interest yearly so that the loan is stable.

EXAMPLE:

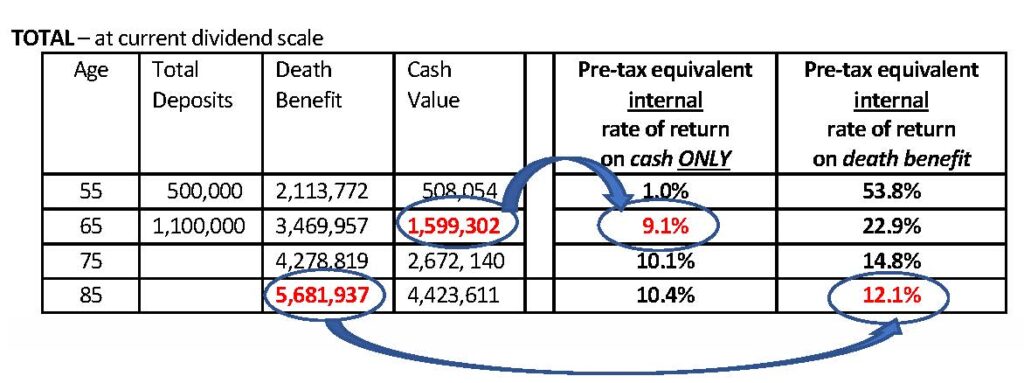

Dr. Brown is a 45 incorporated physician and she invests $50,000 into a participating whole life plan owned and paid by her corporation. She is looking for long term growth which means she is putting the maximum into the policy for 20 years. Here are the numbers at the current dividend rate.

At retirement (age 65)

Dr. Brown can access the cash value of her insurance tax free ($1,6M). If she had invested $50,000 per year in any other investment, in order to have $1,6M after tax, she would have to earn a pre-tax annual rate of return of 9.1% and she has permanent life insurance. In addition, the policy continues to grow over time so she can continue to access additional funds if need be. This shows that life insurance is an excellent asset class.

As an estate planning tool (age 85)

Assuming Dr. Brown passes at age 85, her corporation will receive $5.6M tax free. The corporation will then pay out a capital dividend of $5.5M tax free to her heirs (the difference of $100K is paid out as a taxable dividend). If she had invested $50,000 per year in any other investment, in order to get back $5.5M tax free she would have to earn a pre-tax annual rate of return of 12.1%.

These two scenarios show that life insurance is an excellent asset for retirement savings and for estate planning.

Can your corporation own and pay for life insurance?

YES. An advantage of corporate owned life insurance is that the corporate tax rate is usually lower than the shareholder’s marginal tax rate; there is typically a cost advantage to having the corporation own the policy and pay the insurance premium where the corporation owns a policy on the life of a business owner.

Is a corporate owned life insurance policy taxed when I pass away?

No. Upon your death, the corporation receives the proceeds of the life insurance, and will credit its “capital dividend account” by an amount equal to the proceeds less the policy’s adjusted cost base. The corporation is then able to declare a capital dividend, which will allow the proceeds in the corporation’s capital dividend account to flow to the corporation’s shareholders. The shareholders, who may be your estate, your spouse and/or your children, are not taxed on the receipt of a capital dividend.

*The capital dividend account (CDA) is a notional account created in the income tax act section 89(1). The CDA tracks tax-free surpluses in private Canadian corporations. CDA balances can be distributed to shareholders as a tax-free capital dividend. At any time, a balance exists, a corporation can declare a capital dividend which will allow the proceeds, up to the CDA’s balance, to flow to the corporation’s shareholders (in the case of life insurance, most likely the estate) tax-free.

How are my other corporate investments taxed?

Most clients forget about tax on the shares of their corporation; and this tax can be significant. Generally, when the principal shareholder of the dies and is survived by their spouse, the corporate shares can be transferred to a spouse or spousal trust tax-free (a “spousal rollover”). They then control the corporation and may draw income from it as desired.

When you and your spouse pass away and the corporate assets are sold and distributed, there are up to 3 levels of taxation that may occur.

Tax 1 – Shareholders’ terminal tax return – Personal capital gain on the deemed disposition of shares of the corporation.

In most cases, a corporation is set up with a book value of $1. Assuming no other tax planning, that will remain the case. At death, the MPC shares will be assessed for their Fair Market Value (“FMV”). The difference between the FMV and book value will be taxed as a capital gain to the estate.

Tax 2- Corporate tax on the sale of corporate investments.

For the beneficiaries to receive their portion of the corporation’s investments, these investments must be sold. This disposition results in a taxable capital gain.

Tax 3 – Dividend tax on distribution of assets out to your heirs.

When proceeds inside of a corporation are distributed to heirs, they are distributed as dividends. If the corporation has a CDA balance, then tax-free capital dividends may be paid to heirs. The remainder of assets (usually the majority of corporate assets) are paid out as taxable ineligible dividends. The ineligible dividends are taxable in the hands of the heirs who receive them at their marginal tax rate.

What is post-mortem planning?

When an individual owns shares in a private corporation, post-mortem planning can reduce or elimination double taxation that can result from the deemed disposition of shares and the tax liability on the final distribution of assets out of the corporation.

- The loss carry-back strategy reduces or eliminates tax 1 (capital gains tax in the deceased terminal return) from the deemed disposition of corporate shares when the estate receives a deemed dividend on redemption of the shares issued to it by the corporation.

- The pipeline strategy results in a capital gain being reported in the terminal return of the deceased instead of a deemed dividend for the estate.

The bottom line

While you are accumulating assets, whole life insurance is a conservative asset class that is not subject to tax on the investment growth and is guaranteed to grow each and every year. As you are paid dividends on the anniversary date of your policy, your cash value and death benefit grow and are vested. When you want to access the cash value in your policy (i.e. at retirement), you can do so tax efficiently. From an estate planning perspective, life insurance is flows through your corporation far more tax efficiently than any of your other corporate investments.

We are here to assist. Feel free to reach out.

CONTACT ME TO TO REVIEW MY INSURANCE.

Elliott Levine, MBA, CFP is the President of Levine Financial Group

416-222-1311 I info@levinefinancialgroup.com