I’ve seen how a heart attack or cancer affects a family and I can tell you no matter what your financial situation, when someone has a critical medical problem such as a heart attack, cancer or stroke, delivering a tax free lump sum cheque alleviates a lot of stress and just makes life easier.

Here are the facts:

- One out of three Canadians will suffer a critical illness during their lifetime

- Cancer: 40% of men and 35% of women develop cancer in their lifetime

- Heart disease: 50% of men and 30% of women suffer from heart disease during their lifetime

- Stroke: 75% of stroke victims are admitted to hospital survive

How does a critical illness insurance policy integrate with your disability insurance?

A critical illness policy pays you regardless of your ability to return to work and is paid independent of your disability coverage.

How much coverage should you own?

Most of our clients mirror their critical illness lump sum payment to the amount of their annual income and/or tax liability

How long after I claim do I have to wait to get paid?

There is a 30-day waiting period.

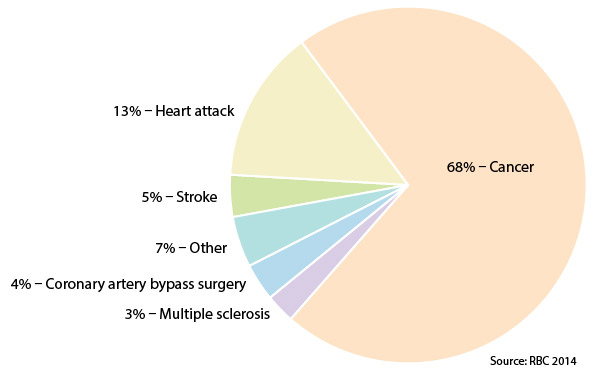

What are the primary critical illness claims?

Cancer heart attack and stroke are the primary illnesses

Can your corporation own and pay for critical illness insurance ?

YES. Your corporate tax rate is lower than your personal tax rate so many of our incorporated clients have their policies owned and paid for by their corporations. If your policy corporate owned and you need to make a claim, the benefit will be received tax free by your corporation at the time of claim and can pay this out to you as a taxable dividend.

If you have any questions on critical illness insurance please feel free to reach out.

Elliott Levine, MBA, CFP is the President of Levine Financial Group in Toronto

We Save Physicians Money on their Insurance

416-222-1311 I info@levinefinancialgroup.com