Dr. Smith and Dr. Brown are 50-year-old physicians and live next door to one another. Each earns $750K and has no mortgage on their home. They both have $500K in RSPs and $1,2M in corporate investments where they invest an additional $250K a year. Both plan to retire at 70.

What sets them apart?

Each invest their corporate assets differently.

Dr. Smith earns an average return of 5% on a diversified portfolio. He doesn’t own life insurance and feels he has more than enough in assets should he predecease his spouse. At age 70, he will have $2.4M in his RSP and $8.5M in his corporate portfolio.

Dr. Brown also earns 5% on her portfolio. She invests her $250K differently, however, putting $100K into corporate investments and $150K into a participating life insurance policy. At age 70, she will have $2.4M in her RSP and $4.5M in corporate investments. She will also have cash value of $4.6M in her participating policy, and a death benefit of $8.7M[i].

Is one better off?

It depends on when you compare them.

Ages 50-69

During their working years, Dr. Smith has more in liquid assets. He pays more tax, however, as corporate investments are subject to a tax rate of 50.17%. His portfolio is also subject to market volatility. Dr. Brown pays less tax as the funds she invests in her participating whole life portfolio grow tax-free. These funds are also guaranteed to grow every year, and unlike traditional investments, she can access her policy cash value tax-free.

Age 70-84

During retirement, both physicians have more then enough assets to provide an income of $300K per year.

At life expectancy

Both physicians have significant assets in their corporate investments. They want these assets distributed to their heirs after they and their spouses pass away. This is where Dr. Smith and Dr. Brown see significantly different results – in the net after-tax funds passed to their heirs. Each faces up to three levels of taxation when they pass away and their corporate investments are sold and distributed.

-

- Personal capital gain on the disposition of shares of the corporation.

At death, the value of the corporation’s shares is the fair market value of the corporate investments. Because the shares are deemed to have been disposed, this value will be taxed as a capital gain on the original share value. - Corporate tax on the sale of corporate investments.

In order for the beneficiaries to receive their portion of the corporation’s investments, they must sell them. This sale results in a taxable capital gain. It also generates a refundable dividend tax on hand (RDTOH) and a capital dividend. - Dividend tax on distribution of assets out of the corporation.

When the investments are sold and cash is distributed to their heirs, the distribution is a dividend taxable at the heirs’ personal tax rate.

- Personal capital gain on the disposition of shares of the corporation.

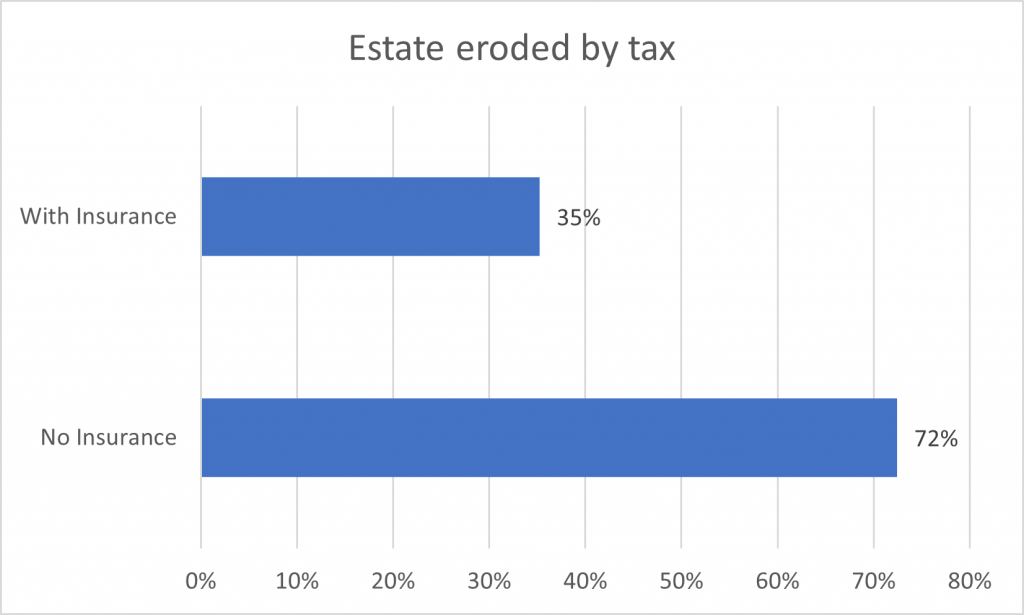

Dr. Brown pays 35% tax – Dr. Smith pays 72% tax –

Dr. Brown pays 35% tax – Dr. Smith pays 72% tax –

All else being identical would you rather pay 35% or 72% tax?

Dr. Smith focused on asset accumulation and didn’t think through the tax implications to his estate. Dr. Brown focused on accumulating assets efficiently, minimizing tax and using the tax-preferred treatment of life insurance to enhance her estate. Should she have needed additional funds during retirement, she could have accessed up to $4.6M tax-free from her participating policy.

The amount of tax your beneficiaries will pay ultimately depends on the type of post-mortem planning you do, and the tools you put in place for when you and your spouse pass away. One tool that’s locked-in, guaranteed and flows through your corporation tax-free is permanent life insurance.

If you could talk to your future self, can you imagine yourself saying you wish you had more or less

life insurance?

If you want to revisit your insurance, or if you have friends or colleagues who may be unsettled with their insurance, we would be happy to have a chat with them. Feel free to click here, call Elliott or Efe at 416-222-1311 or email info@levinefinancialgroup.com

Elliott Levine, MBA, CFP is the President of Levine Financial Group in Toronto

We Save Physicians Money on their Insurance

416-222-1311 I info@levinefinancialgroup.com

[i] Illustrated at the 2020 dividend scale for Sun Life of 6.25%.